Ratio analysis is a powerful tool used to evaluate a company’s financial performance by interpreting data from its financial statements. This method provides valuable insights into various aspects of a company’s operations, efficiency, profitability, and financial health.

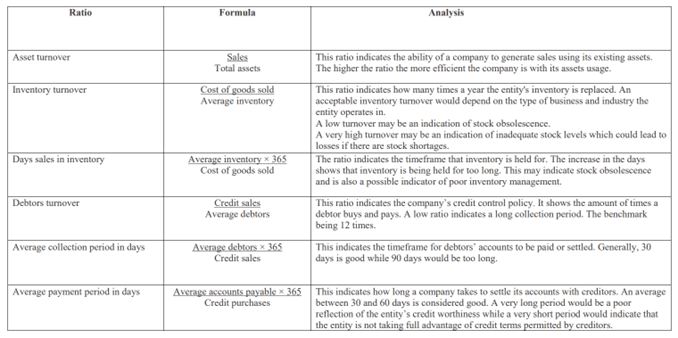

Below tables provide a summary of the key concepts, categories, formulas, and relevance of some of the commonly used ratios used by the stakeholders to make an informed decision–

FINANCING RATIOS

LIQUIDITY RATIOS

ACTIVITY RATIOS

While ratio analysis is very useful for performance evaluation, trend analysis, comparison with peers, investment decisions, assessing the credit worthiness of a company, identifying potential financial risks, etc., one needs to carefully consider the below listed limitations as well –

Limitations of Ratio Analysis

- Historical Data: Ratios are based on past data and may not predict future performance.

- Industry Differences: Ratios can vary widely between industries.

- Accounting Policies: Differences in accounting practices can affect ratio comparability.

- Quantitative Nature: Ratios do not capture qualitative factors like management quality.

Leave a comment